PYRAMIDING STRATEGY (AVERAGING FOR PROFIT)

— By Divyam Parashar

Founder and CEO, Upmarket Academy

Before we start, what is Averaging?

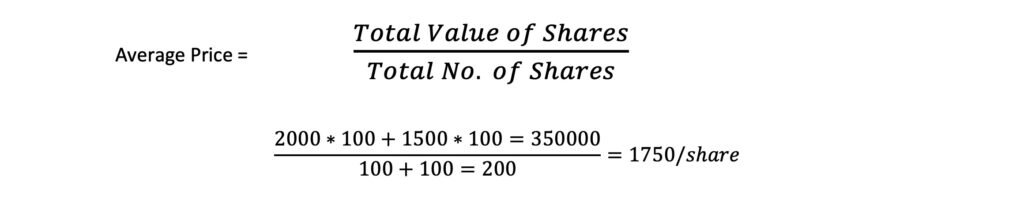

So, in trading, whenever you create a position, for example you buy 100 shares of Reliance @ 2000 and then the share price falls back to 1500 and you buy another 100 @ 1500 so your buying price which was earlier 2000 will not get averages to 1750/share.

Now traders usually misuse this by buying or selling into a losing trade which is also known as Averaging down, in the hope that the option or future or stock will eventually come near its average price at least and they’ll exit then and there, but this happens rarely and rather, they end up losing more money than what they would’ve if they didn’t average.

Example –

What’s the correct way to use Averaging?

I’m not saying that averaging down is wrong every time, but until you’re a polished trader, it’s more likely that your averaged down trades will end up blowing your account. But if you use this strategy the other way around, you can make more money and lose less using Averaging.

How?

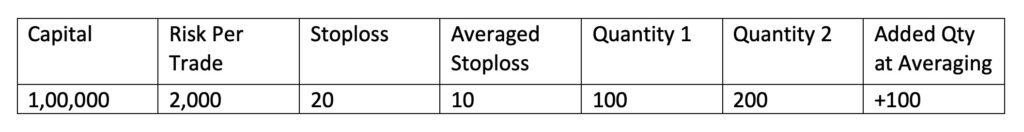

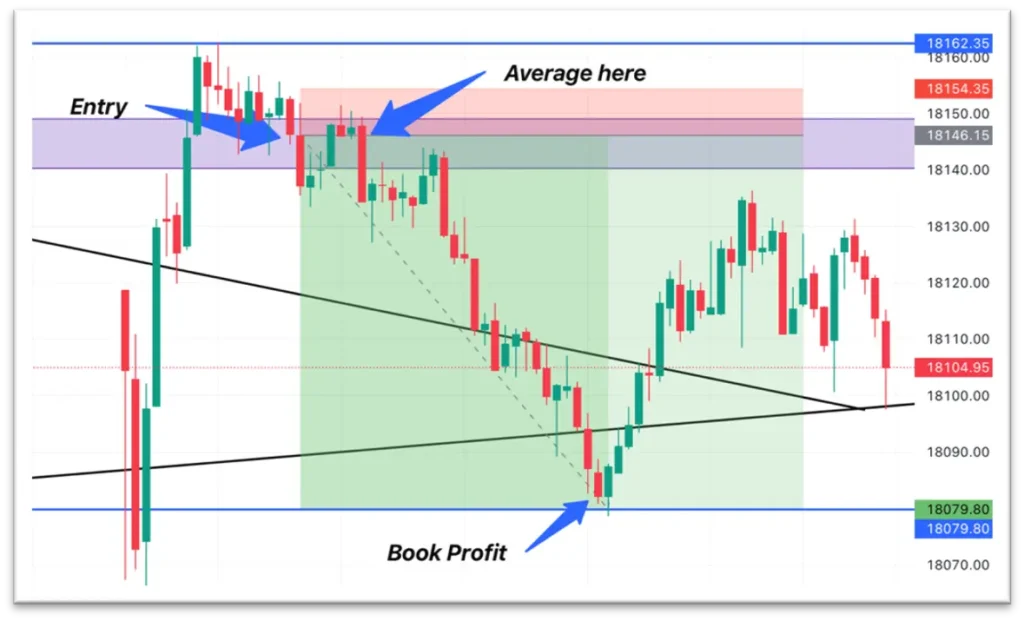

So when you take a trade, say it’s a breakout trade as mentioned below you short the market @ 18145 and place your stoploss @ 18165 so you can short 100 contracts.

Then the market goes up again for a retest, this is where you enter again as this is a confirmation for you and time for you to trail your stoploss @ 18155 therefore, your stoploss decreases to just 10 points, so you now can add more quantity, 2000/10 = 200 and you already shorted 100 contracts in the first entry so this time you add 100 more.

How will this benefit you?

So if a person is not using this Pyramiding strategy, they make 65 * 100 = 6500 in this trade with a risk of 2000 whereas the person who used the pyramiding strategy they make 65 * 200 = 13000 with the same risk of 2000.

Use Pyramiding mindfully and this can get you ahead of competition and help you make a great career.

I hope you liked this strategy and our representation! For any queries Comment on the Video

Hope you love it!

Good Luck!

Divyam Parashar,

Founder & CEO

UPMARKET ACADEMY PRIVATE LIMITED

*Terms and Conditions apply*